Laadbehoefte in de praktijk

Laadbehoefte in de praktijk

In de Logistiek+ komen kennis, praktijk en verbeeldingskracht samen. Met concepten, tools en inzichten over hoe logistiek kan bijdragen aan een gezondere stad, een slimmere keten of een eerlijkere economie. Voor wie verder wil kijken dan efficiëntie en wil ontdekken wat er gebeurt als je logistiek verbindt met maatschappelijke opgaven.

Laadbehoefte in de praktijk

Modaliteitskeuzes: van Lopen tot Hyperloop

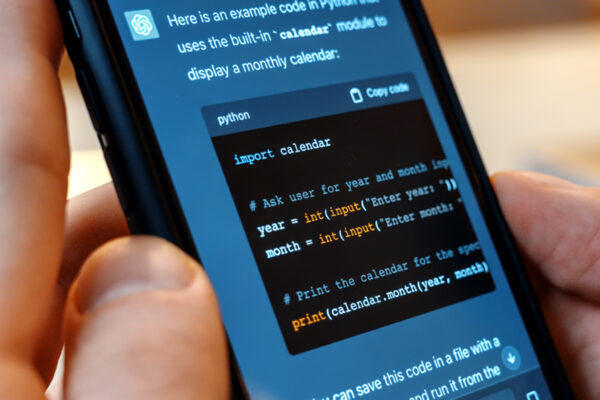

Large Language Models in de Logistiek

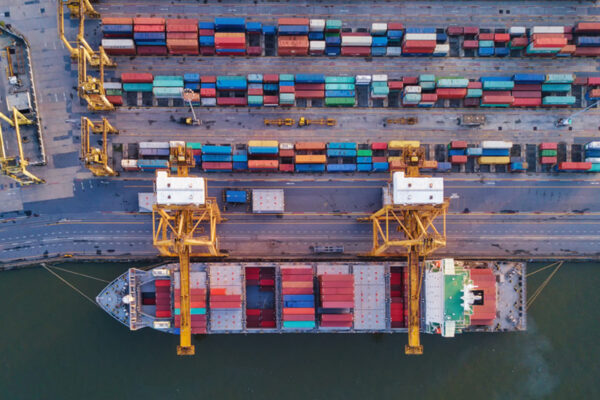

De rol van Nederlandse binnenhavens in de modal shift

Datagedreven magazijnoptimalisatie voor het mkb

Afstemmen van nachtdiensten op het chronobiologisch ritme

Zero-emissiezones: kans of knelpunt voor de stedelijke logistiek?

Circulaire ketens: van uitdaging naar kans voor logistieke dienstverleners

Hoe identiteit als kapstok kan helpen bij patiëntgerichte en betaalbare zorg